There's a reason setups stop working.

Not because the market "changed." There's an actual mechanism behind it, documented, measured, predictable. And once you understand it, you'll see why most traders are always one step behind.

The pattern is simple. Someone discovers an edge. It works. They talk about it, teach it, post it. Others notice. They pile in. The edge compresses. Eventually, it stops working entirely. And everyone moves on to the next thing, wondering what happened.

This isn't theory. It's been studied at the institutional level for decades. The research is uncomfortable reading for anyone who thinks a good setup stays good forever.

The Half-Life of an Edge

London Business School tracked 1.8 trillion dollars worth of trades across 692 portfolios. They wanted to know exactly how long “alpha” lasts, not in theory, but in practice.

The answer: about twelve months.

Alpha decayed from 37 basis points in month one to essentially zero by month twelve. The decay followed a power function with near-perfect fit. By month three, cumulative alpha had reached only 0.59%. By month eighteen, it peaked at 1.41% and flatlined.

That's the natural decay. The half-life of an edge when nothing accelerates it.

But something usually does.

The Publication Effect

McLean and Pontiff published a study in the Journal of Finance that should be required reading for anyone who trades. They examined 97 anomalies, published strategies that had been documented in academic papers.

Returns dropped 58% after publication.

Not over years. Almost immediately. And 32 percentage points of that decay was directly attributable to publication-informed trading. People read the paper, traded the strategy, and compressed the edge until it barely existed.

The strategies that looked best in backtests deteriorated fastest. Higher in-sample returns predicted greater post-publication decay. The better something appeared on paper, the more aggressively it got crowded once others could see it.

This is the mechanism nobody talks about. The edge doesn't disappear because it was fake. It disappears because it was real, and visibility killed it.

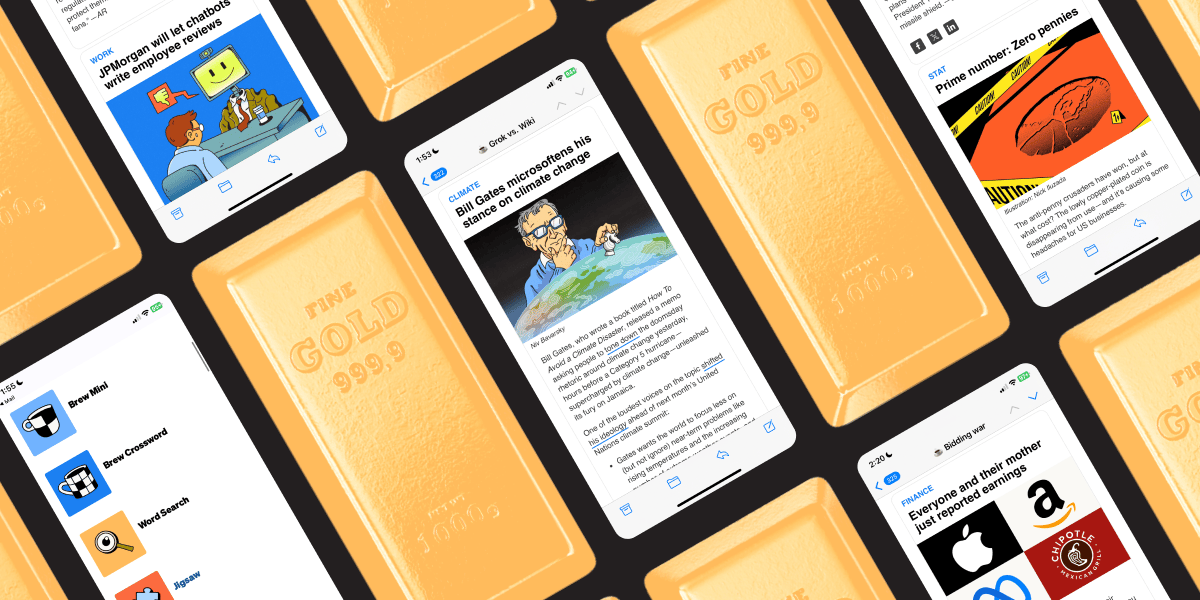

Staying sharp isn't just about charts. Morning Brew covers business and finance in five minutes, I read it most mornings with coffee. Worth a look.

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Why This Applies to Everything

The same pattern appears in business. Golder and Tellis studied first-mover advantage and found that 47% of market pioneers fail entirely. The survivors averaged just 10% market share. The companies that actually won? They entered thirteen years after the pioneers, on average.

They let others validate the market, make the mistakes, educate the customers. Then they moved—after visibility had done its damage to the first movers but before the window closed completely.

Wiggins and Ruefli tracked 6,772 firms across 40 industries over 25 years. Only 0.35% to 2.9% maintained superior performance for two decades. Sustainable competitive advantage isn't rare. It's almost nonexistent.

The edge, in markets and in business, belongs to whoever sees it during the window. Not before it opens. Not after it closes. During.

The Visibility Problem

Here's where this gets practical, {{first_name}}.

Most traders see setups after they've become visible.

The candle closes. The level breaks. The pattern completes. They enter.

But by the time a setup is visible on a chart, it's already being seen by everyone looking at the same chart. The same timeframe. The same indicators. The same YouTube breakdown from last week.

That's not the window. That's after the window.

The 58% decay doesn't happen over months for retail setups. It happens in minutes. The moment price action "confirms" the level, the level has already absorbed most of its edge. You're not trading the setup. You're trading what's left of it after visibility did its work.

Liquidity is different.

Liquidity levels exist before price advertises them. They're structural, where institutions need to fill, where stops cluster, where the order book is thin enough for price to move. They're not patterns waiting to complete.

They're conditions that exist right now, visible only if you know how to see them.

That's the difference between trading inside the window and trading after it closes.

The Window That Matters

The research is clear on this. Edges decay.

Publication accelerates decay. Visibility compresses returns toward zero.

But the research also reveals the gap. The twelve months of alpha decay assumes everyone can see the setup at the same time. The 58% post-publication drop assumes the strategy has been published.

What hasn't been published yet still has its edge intact.

The indicator I use plots liquidity in real-time, where it sits, where it's building, where price is likely to reach for it. Not after the candle closes. Not after the breakout confirms.

Some traders find that visibility useful when they're tired of entering after the edge has already decayed.

Talk soon,

Atif